SUMMARY

- The shortage is just getting started

- Everything is intentional

- The collapse of the monetary system

- More on Food and Energy crisis

- Crude oil is going to $200/barrel

- Politicians are making the problems worse

- SPR release will backfire again

- Rising interest rates won’t cure inflation

- Why we bought Coal India and Natural Gas

“The Cassandra complex is a psychological phenomenon in which an individual’s accurate prediction of a crisis is ignored or dismissed.”

It was not too long ago that we warned about a food crisis. We first posted about it on Reddit in October and also in the first issue of our newsletter in January that you can read over here. Not many people believed us but here we are.

Fast forward a couple of months from our initial prediction, and now we have Joe Biden and Justin Trudeau saying that we’re going to have tough times ahead and a food shortage. Could you imagine that a couple of months ago? The leaders of two of the world’s most developed countries saying there’s going to be a food shortage?

Well, we did foresee it.

They’ll try to give you many reasons for the upcoming famine; climate change, Russia, COVID. But do not be fooled, it is the consequence of the decisions of the elites (politicians, bureaucrats, billionaires) worldwide.

Everything is Intentional

Lockdowns, starving investment into fossil fuel industry, closing down nuclear plants, pushing for solar and wind energy, all these things have contributed to the energy crisis we’re having. And since energy is required to produce all things, including food, the crisis is turning into a food crisis.

So why are the ruling elites hell bent of starving and freezing people to death? Well, there could be two reasons:

- They’re stupid

- They’re doing it intentionally

Hanlon’s razor would suggest that reason number 1 is the answer. Afterall, you should never attribute to malice that which can be adequately explained by stupidity. However, we at The Logical Traders firmly believe that they’re doing it intentionally.

The collapse of the Monetary System

So why are they doing this?

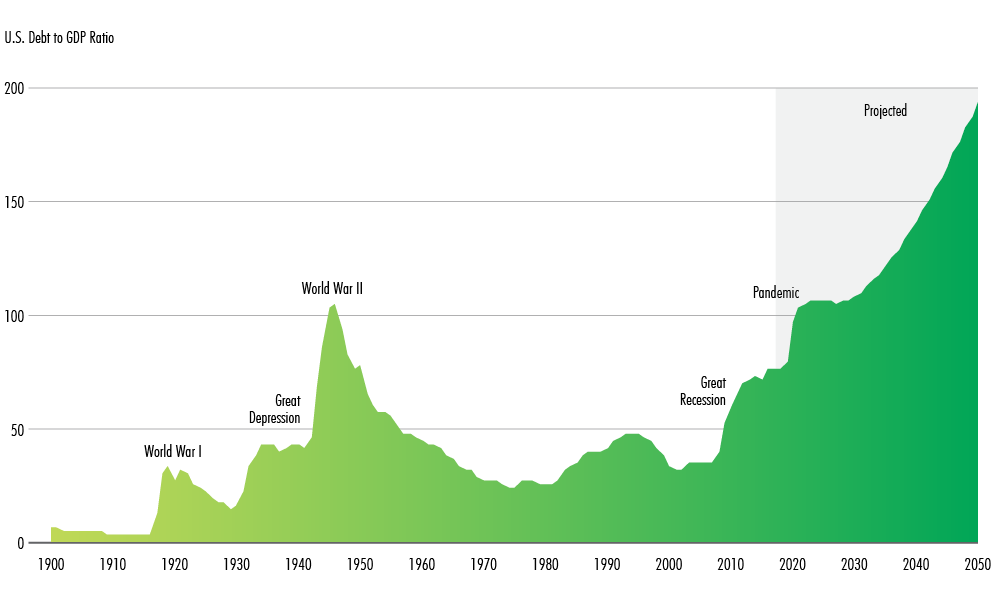

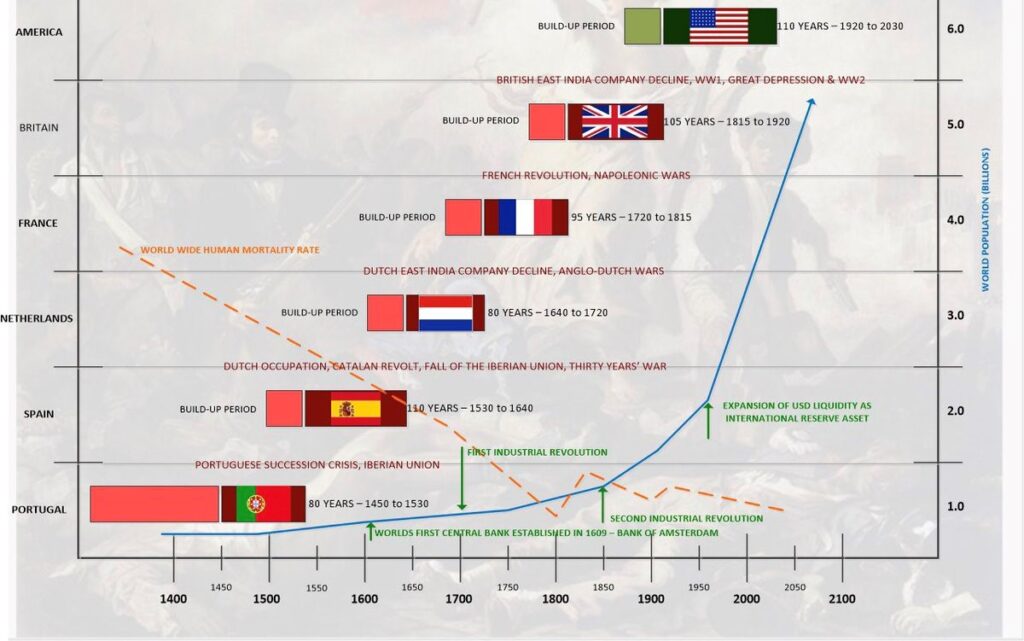

As per my best guess, they’re doing this because our debt-laden system is headed for a collapse and we will need a monetary reset of some form in the future. This is why the elites are taking decisions that is making everything worse, from sanctioning Russia to demonizing fossil fuels.

It is mathematically impossible to pay back this debt. Human nature never changes, which is why everything in history has moved in “cycles”. And judging by history, it seems like the U.S. dollar’s status as the reserve currency will come to an end in the coming years.

This doesn’t, however, mean that the value of the USD will fall. Quite the contrary, we expect it to increase going into the collapse because most other currencies are worse and the reserve status creates demand for the USD.

More on Food and Energy Crisis

Everyone understands by now that Russia is a large energy producer, but what many don’t know is that when they sit down at the dinner table at night, the entire supply chain (aside from the energy required for transportation) that gets them that dinner involves Russia and Ukraine to a frightening degree.

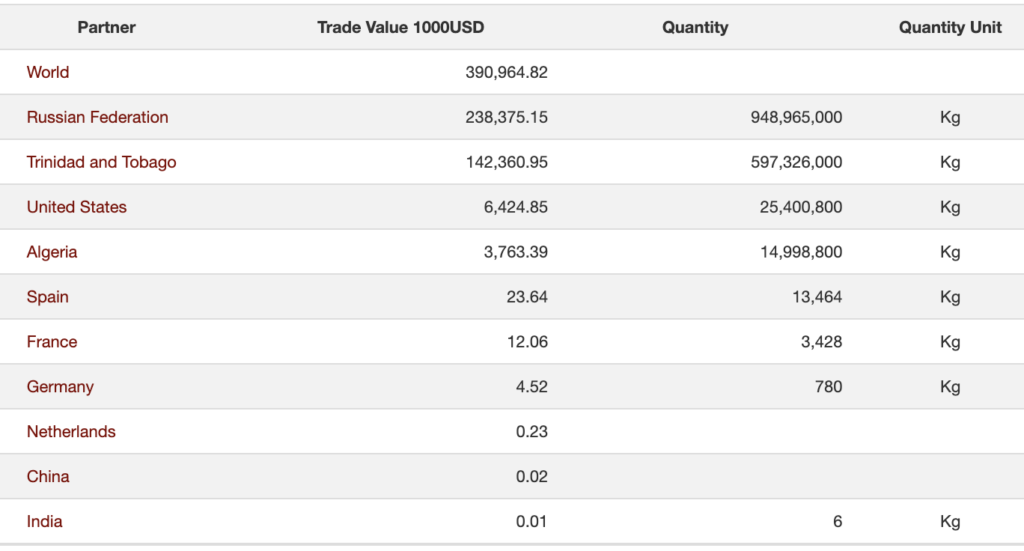

You see, our current globally integrated food supply system and mass food production cannot exist without fertilizer. This includes three main categories: nitrogen, potash, and phosphorus fertilizers. Potash is a potassium-rich salt fertilizer that enhances plant quality and is responsible for 20% of global fertilizer demand.

Together with Belarus, Russia has a 40% market share in global production and export of potash fertilizer. What OPEC+ is to the oil market, Belarus and Russia are to the potash market. The two monopolies in this space are Uralkali and Belaruskali, with the Belarusian Potash Company being the latter’s export arm.

With 16.5% of the nitrogen fertilizer market, Russia may not appear to be that dominant until we look at the key ingredient (ammonium nitrate) and then we realize… oh boy, yes, it is. You see, it holds a whopping 66% of the global market share in the production of this chemical, and without it there’s no nitrogen fertilizer.

All this matters a great deal for those of us who like to eat, because Russia recently imposed an export ban on the ammonium nitrate. Their reasoning, true or not, was to ensure an affordable supply for its own farmers. This ban comes off on 2 April.

“Fine, what’s a few weeks wait,” you say.

Well, farming isn’t like manufacturing iPhones. If you’re missing some component of the phone, you can plonk it in a month or two later and it’ll all still work. Sure, your overall operational expense related to storing the product for longer than anticipated is a little higher, but it’ll still work.

Try that in farming and you miss your planting cycle. You miss your planting cycle and you can literally go bankrupt. It’s a big deal, and it’s going to have a lasting impact on anyone who needs food.

“The Moroccan state-owned OCP group has maintained its leading position as the world first exporter of phosphates although its market share decreased from 38 pc to 34 pc between January & September 2019, but in phosphoric acid, the Group remains the biggest worldwide exporter, with a 49 pc global market share.”

So what does this have to do with Russia?

Well, through the company Uralchem, Russia provides ammonia to Morocco, and Morocco, as it turns out, is the largest phosphate fertilizer producer in the world with 75% of phosphate reserves.

How much ammonia? More than half.

Russian fertilizer companies have recently gained a monopoly over imports of phosphate fertilizer into Europe over the past year by supplying low cadmium fertilizer, which became required under a new EU directive in 2019. Morocco, Europe’s foremost supplier, has higher cadmium levels in their phosphate fertilizer, putting them at a disadvantage.

Crisis all around. Now you know why we bought GNFC, Madras Fertilizer, Godrej Agrovet and RCF. Apart from stocks, it would a bit silly for anyone to not own Gold on the brink of a potential monetary collapse.

All in all, food prices are going higher and this will lead to massive riots across many countries in the world. The last time wheat prices rose this much, it gave rise to the Arab Spring 2010s so don’t expect this time to be much different.

People can endure a lot of oppression, but when they can’t feed their families, they pick up pitchforks and torches. It has already happened in Kazakhstan, Sri Lanka and Peru this year, we expect it to spread further.

Why Crude Oil is going to $200 per barrel

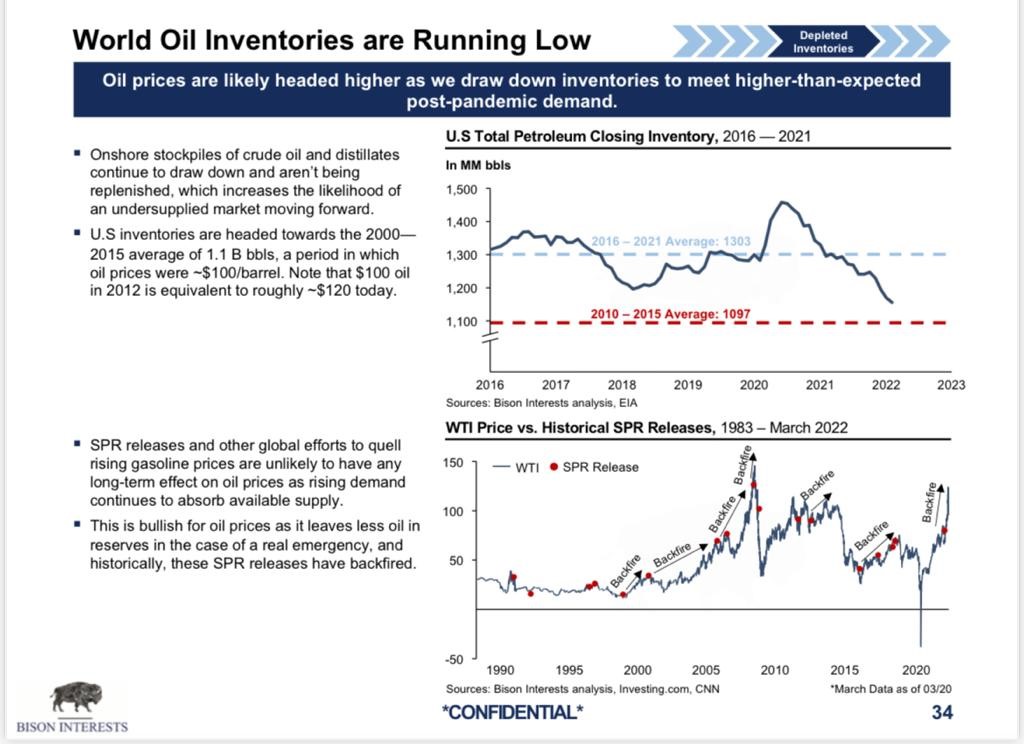

Remember when we said our conservative price target for oil for $150/barrel for the next two years? Well Brent crude crossed $130 this month. Not bad. It didn’t hit $150 right away, but that’s good because we think we’re in a bull market for commodities and a healthy bull market shouldn’t have erratic price movements.

But now we’re moving our price target up to $200/barrel. So yes, expect your petrol to become expensive, unless of course there’s an election around the corner.

Why $200?

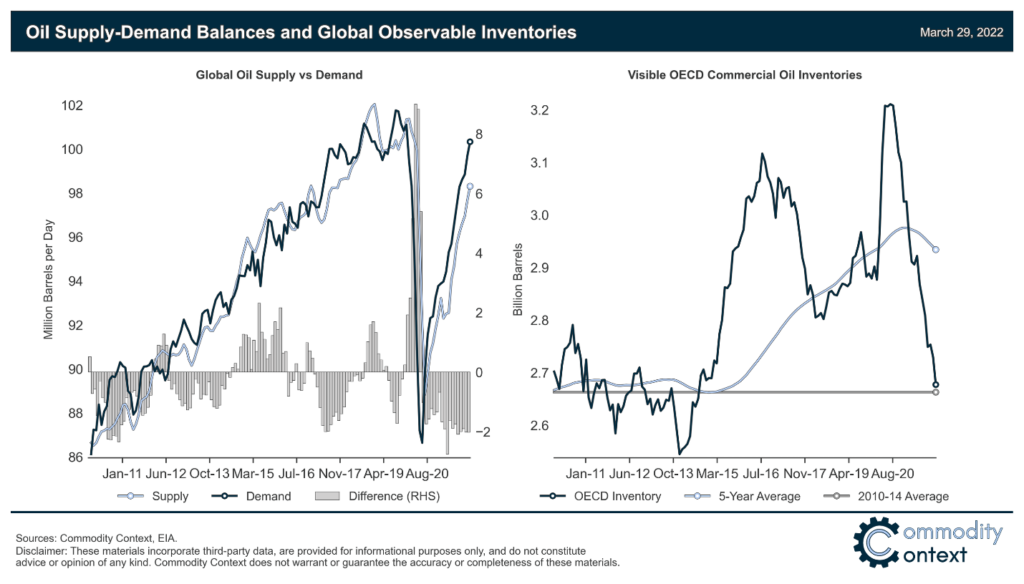

The answer again would be government policies. You see the demand for oil is increasing, even though we’ve crossed $100 mark.

You can see evidence of this in India too.

The poor people will struggle to survive, but the rich Indians are getting richer and spending on business class airline seats and 5-star hotels, adding to the demand for oil.

But you see, the most powerful man on Earth, Larry Fink, has decided that oil is dirty and bad for the environment. He has $13 trillion in assets under management and is starving the industry of investments.

Without new investments (or capital expenditure) into property, machines, etc., the supply for oil will not increase to match the demand. And if you know basic economics, if demand is rising and supply is not, the only place for oil price to go is up. Waaaay up.

That’s Not All Folks

You can always count on government to make the problems worse. And boy do they never disappoint. Several European countries and states in the US are cutting tax on oil whereas states like California are handing out $400 per car “relief” checks (something we said was going to happen in issue 2) to help people pay their oil and gas bills.

What will this do, you ask?

Obviously, this will increase the demand for oil and in turn cause massive inflation. Rising prices usually lead to slower consumption, but when governments interfere and start cutting tax or offering stimulus checks, demand stays high despite rising prices, making the problem worse.

And THAT’S NOT ALL. The politicians are planning to make the supply side issues worse too. Western politicians in several countries are contemplating levying a windfall tax on “greedy” oil companies for making a lot of money during this crisis. How dare they make money from the crisis, right? Only vaccine companies are allowed to do that.

Both these things will further add to the demand and lead to double digit inflation going forward as oil price soars.

More Bullish Oil News

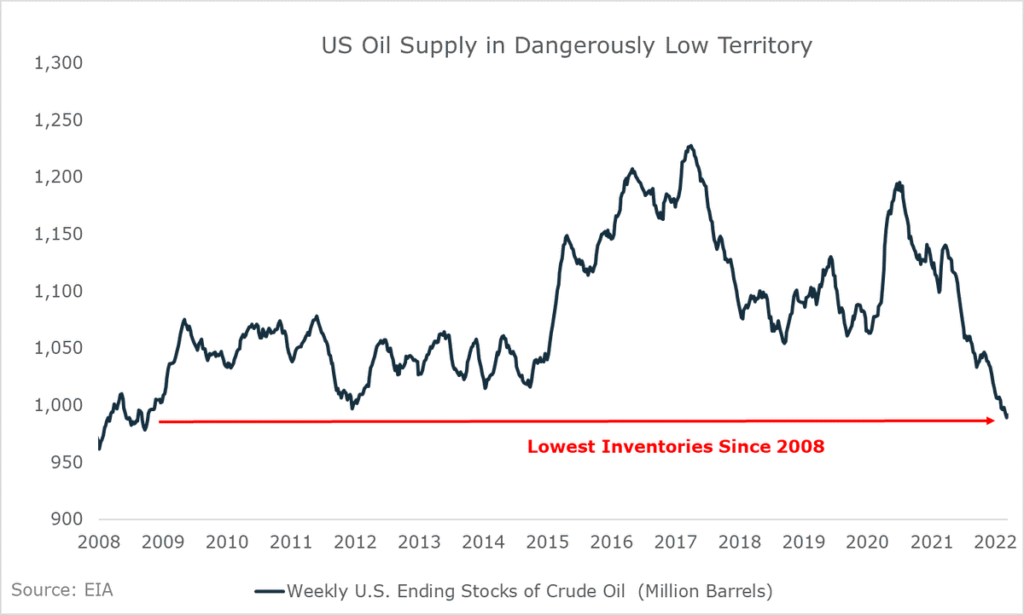

Joe Biden has decided to release 1 million barrels per day of oil from the US Strategic petroleum reserve for the next 6 months. This, to me, reeks of desperation. The SPR is supposed to be used during emergencies like fueling fighter jet planes during a war in case of shortage.

But Biden is using it so that the Democrats do not get obliterated in the upcoming midterm elections. They will anyway because inflation is running hot. And releasing SPR reserves has almost always backfired as the prices have risen soon after as you can see from the image below.

Stagflation is Coming

To try to fight off this inflation, Federal Reserve will have to increase interest rates and the bond market is already anticipating this as yields are rising and bond prices are falling.

I don’t think many people understand the implication of rising interest rates. You see, low interest rate environment has forced money into higher-risk investments globally. And 1 symptom of trillions of dollars chasing riskier and risker investment is the rise of many modern-day Ponzi companies that do not make any money but have a massive valuation due to rapid revenue growth.

Zomato, Oyo, Swiggy, Uber, Cred, WeWork, Peloton, the list is endless. But now with inflation rising at the fastest pace in decades, the central banks across the world are caught between a rock and a hard place.

If they raise interest rates to try to control inflation, these Ponzi companies will collapse and the stock market will take a beating too. But if they don’t raise interest rates, inflation will keep on rising and that is never good. Riots will break out, crime will increase, governments will fall. There seems to be no way out without pain.

Increasing interest rates usually puts a leash on inflation but we don’t think it will work this time. You see, prices are rising because there’s shortages. And increasing interest rate will not solve these shortages. People will still need food to eat, petrol to drive and coal to provide electricity for their homes and business.

Speaking of Coal and Natural Gas

Coal has faced the same supply side issues as other fossil fuels, which makes sense since it is a dirty source of fuel. Opening new coal mines is considered politically incorrect. But we believe the demand for coal is going to increase massively going forward.

You see, whenever the price of Natural Gas rises too much, countries often shift to coal as a substitute. And since Natural Gas in Europe has gone parabolic due to the war, countries are slowly shifting to coal, leading to an increase in demand.

But as is the case with oil, the increased demand can’t be met with increased production. A lot of coal miners have gone bankrupt over the last few years and now there’s no additional supply. And this means, again, the price of coal is going to go up.

And since coal is used to generate electricity that is used in industries, the manufacturing cost, especially of energy-intensive products like aluminum, will go up. Everything is going to become more expensive and we believe Coal India stands to benefit from it. Plus it’s dividend yield is nearly 9% so we’re comfortable holding the stock.

And to explain why we bought Natural Gas and continue to hold it, I’d like you to read these paragraphs from a Bloomberg article:

“Provoked by Russia’s invasion of Ukraine and its threat to cut off natural gas exports to Europe, the European Union says it intends to wean itself off Russian supplies entirely within a few years. It’s a tall order, as Russian gas covers about a third of the continent’s consumption. A crucial part of the plan is to greatly increase purchases of liquefied natural gas from non-Russian producers. The extent to which global LNG supply can expand is constrained, however, setting Europe up for a battle for supply with Asian buyers. That risks precipitating higher prices and energy shortages that could compel Asian countries to shift to dirtier fuels, compromising climate goals.

Global LNG production — led by the U.S., Qatar, and Australia — is expected to reach 452.8 million tons by the end of the year, figures from Bloomberg Intelligence show. Based on weekly traffic, roughly 70% of cargoes on the water are reserved for customers holding long-term contracts while the remaining 30% is being sold on the global spot market. That means roughly 136 million tons of LNG this year will go to the highest bidder. In theory, that’s enough to cover Europe’s imports from Russia of around 160 billion cubic meters of natural gas, the equivalent of 118 million tons of LNG.

At the moment, European nations are importing around 80 million tons of LNG per year. At maximum capacity, figures from Bloomberg Intelligence show, they can import a combined 145 million tons, which means there’s spare capacity for about 65 million additional tons. So, even at maximum capacity, LNG imports would only cover half of Russian pipeline gas. Also, European nations would need to reconfigure pipeline routes and build interconnections to move the gas from coastal import terminals to demand centers in the interior of the continent.

Already the war in Ukraine has sent LNG spot prices soaring, and the trend is expected to continue. Poorer countries, such as India and Pakistan, that are less able to pay lofty prices could face energy shortages that strain their economies. Higher prices and potential shortages mean utilities in countries such as Japan, South Korea and Pakistan — which rely on imported gas to generate a large chunk of electricity — could shift to more carbon-intensive alternatives like coal and fuel oil, intensifying pollution and compromising efforts to contain global warming.”